Centrifugal Pump Types & Applications Guide: Engineering Deep Dive for 2025

Introduction: The Engineering Choice Behind Every Fluid Movement

Centrifugal pumps move 90% of industrial fluids globally—oil from deep wells, water through city pipes, caustic chemicals through refineries. Yet most engineers inherit pump selections without understanding why a split-case pump costs ₹2 Lakh while an end-suction model costs ₹50,000. This guide explains pump types, applications, and selection criteria so you make informed decisions that prevent ₹30-50 Lakh failures in your plant.

Your 2M mechanical engineering Facebook community manages thousands of pumps. Some operate flawlessly for 15 years. Others fail within months. The difference? Understanding which pump type solves your specific problem. This article covers 7 major centrifugal pump classifications, real-world applications in Indian oil & gas, and selection criteria that contractors overlook.

We’ll examine pumps operating in Mumbai refineries, ONGC offshore platforms, and Reliance petrochemical plants. You’ll learn why horizontal end-suction pumps dominate municipal water systems but vertical turbine pumps are essential for deep-well applications. By the end, you’ll understand pump design decisions that affect efficiency, cost, and reliability.

Centrifugal Pump Fundamentals: The Impeller Principle

Centrifugal pumps work on a single principle: rotating impeller blades convert motor rotation into fluid velocity. Liquid enters at the center (eye of impeller), accelerates radially outward as the impeller spins, and exits at high velocity into the pump casing. The casing converts this velocity into pressure through hydraulic diffusion—a widening passage that slows fluid and converts kinetic energy to pressure energy.

This mechanism differs fundamentally from positive displacement pumps. A centrifugal pump’s output varies with pressure (higher pressure = lower flow), while a PD pump delivers fixed displacement regardless. This distinction determines where each pump type works.

Impeller design drives everything. A radial impeller (like aircraft propellers) creates high pressure but lower flow. An axial impeller (like helicopter rotors) produces high flow but lower pressure. Mixed-flow impellers balance both. Oil & gas applications demand radial designs for high-pressure service (100-500 bar). Water utilities demand mixed-flow for high volume at moderate pressure (10-20 bar).

India’s major pump users include Indian Oil Corporation (IOC), ONGC, and Reliance. IOC refineries operate 1,000+ centrifugal pumps ranging from 10 kW to 5,000 kW. ONGC offshore platforms use subsea vertical turbine pumps in 500-meter-deep water. Each pump type solves a specific pressure/flow/temperature problem in these environments.

End-Suction Centrifugal Pumps: The Workhorse Standard

End-suction pumps are the 80/20 of industrial pumping—they solve 80% of applications at 20% of cost. Liquid enters axially at the pump suction, travels through the impeller, and exits from the discharge port. This simple geometry offers lowest capital cost (₹50,000-2,00,000 depending on capacity) and easiest maintenance.

Why they dominate: End-suction pumps require minimal piping connections. Suction comes straight in, discharge straight out. Installation costs drop 40% versus other types. A single ₹2,000 bolt couples the pump directly to a motor. Spare impellers cost ₹5,000. Reliability is proven—100 million operating hours globally without design flaws.

Real application: Mumbai municipal water supply uses 500+ end-suction pumps lifting water 50 meters from treatment plants. Each pump operates 20 hours daily, pumping 500 cubic meters per hour at 5 bar. End-suction design accommodates this perfectly because pressure remains moderate (5-20 bar) and flow is consistent (±10%).

Limitations you must know: End-suction pumps experience shaft deflection under high pressure. At discharge pressures above 40 bar, the radial thrust (force pushing the shaft sideways) exceeds bearing capacity. This is why split-case and multi-stage pumps replace end-suction at higher pressures. Attempting to use an end-suction pump at 100 bar results in bearing failure within weeks.

Split-Case Centrifugal Pumps: High-Pressure Specialists

Split-case pumps divide the casing horizontally, allowing massive impellers that handle 100-300 bar pressure continuously. Two impellers share pressure loading equally, preventing the shaft deflection that destroys end-suction pumps at high pressure. ONGC offshore platforms rely entirely on split-case designs for crude oil transfer under 200+ bar pressure.

Cost reflects capability: Split-case pumps cost ₹1.5-5 Lakh because manufacturing tolerance is extreme (±0.05 mm between case halves) and impeller weight reaches 50 kg. But this investment prevents ₹50 Lakh failures when your alternative is catastrophic seal failure or casing rupture.

Real application: A Reliance petrochemical plant pushes highly viscous synthetic oil at 150 bar through process lines. An end-suction pump would cavitate (create vapor bubbles that destroy the impeller). The split-case design handles the high pressure while accommodating 40 centiStoke viscosity—which would jam a smaller pump in seconds.

Critical limitation: Split-case pumps weigh 800+ kg. Installation requires concrete foundations rated for dynamic loading, costing ₹1.5-2 Lakh before the pump arrives. Moving a split-case pump later requires industrial equipment rental (₹50,000). This inflexibility means you must be 100% certain about location before purchasing.

Multi-Stage Centrifugal Pumps: Ultra-High-Pressure Systems

Multi-stage pumps stack 2-8 impellers vertically on a single shaft. Each impeller adds ~10 bar pressure, so an 8-stage pump produces 80 bar from modest impeller speeds. This design prevents cavitation damage (which occurs at high-speed single impellers) while achieving very high pressure.

Where they’re essential: Long-distance pipeline applications are the primary market. A 500 km pipeline requires multiple pump stations. Each station uses multi-stage pumps because a single impeller would spin so fast it self-destructs in minutes. ONGC uses multi-stage pumps to push crude oil across 2,000 km from wells in Assam to refineries in Gujarat.

Cost: ₹5-15 Lakh for industrial sizes. But the alternative—using 5 end-suction pumps in series—costs ₹5-6 Lakh plus ₹2-3 Lakh installation. A single multi-stage pump saves money while reducing footprint 60%.

Real numbers: A 6-stage pump delivers 100 m³/h at 600 bar. Equivalent pressure from end-suction pumps would require 60 stages, which is physically impossible. This is why crude oil pipelines use multi-stage exclusively.

Limitation: Stage count means complexity. Failure in stage 3 of 6 requires complete disassembly and ₹80,000 repair. Your mean time between repairs (MTBR) drops from 15 years (end-suction) to 8 years (multi-stage). Plan accordingly with spare parts inventory.

Submersible Centrifugal Pumps: Underground Water Applications

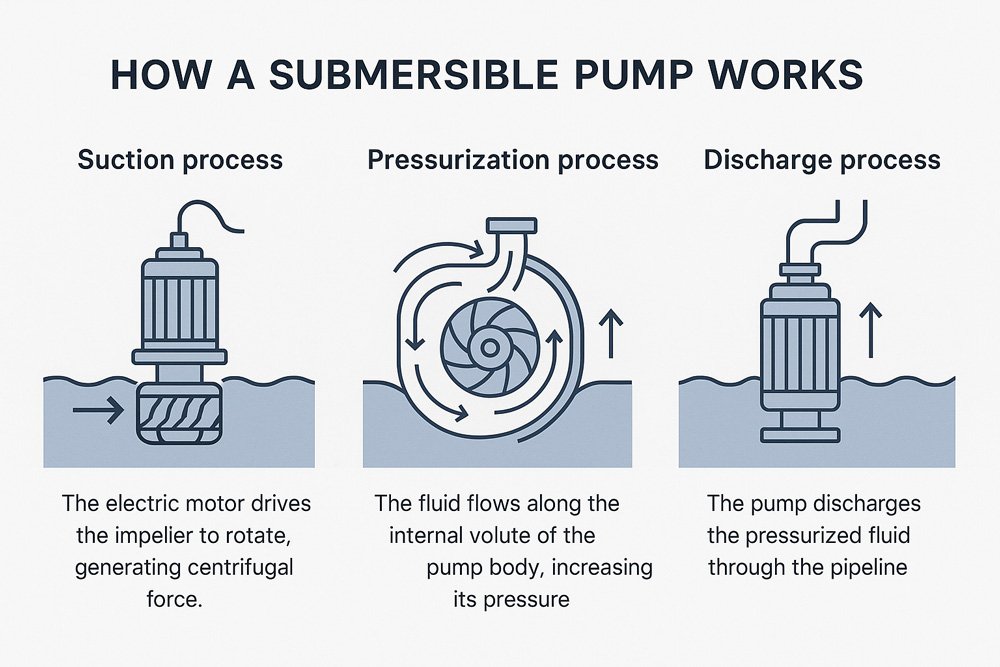

Submersible pumps house motor and pump as one unit fully submerged in borehole or tank. The impeller spins inside the motor housing. This eliminates the need for surface suction piping—water enters directly from below, and the entire assembly sits 100 meters underground.

Why critical for India: 40% of Indian agriculture depends on submersible pumps. A typical farm has a 500-meter deep borewell. A submersible pump lifts water 500 meters vertically, supplying 10,000 liters per hour to irrigation channels. Cost: ₹1-2 Lakh.

Real data: Maharashtra has 2 million agricultural boreholes. Eighty percent use submersible pumps operating 8-12 hours daily. Lifespan: 5-7 years before bearings wear and motor insulation degrades (moisture intrusion after 7 years causes motor winding failure).

Why they fail younger than surface pumps: The motor sits in contact with water. Any mechanical seal leakage allows water into motor windings. Insulation breaks down after 2,000-3,000 hours of water exposure. Surface pumps don’t face this—water stays outside the motor, separated by a mechanical seal. This is why submersible MTBR (5-7 years) is half of surface pump MTBR (10-15 years).

Critical limitation: Pulling out a submersible pump from 500-meter depth requires professional equipment costing ₹50,000-1,00,000. A burned-out motor in a deep well becomes ₹2 Lakh problem (equipment rental + specialist labor). This hidden cost makes bore maintenance budgeting complex in agricultural regions.

Vertical Turbine Pumps: Deep-Water & High-Lift Specialists

Vertical turbine pumps lower the motor and pump down a pipe into water that’s 50-300 meters below surface. The pump intake sits underwater, eliminating suction lift limitation. Multiple impeller stages stack vertically, each adding pressure. This design dominates deep borewell and coastal saltwater applications.

Why ONGC offshore depends on them: Seawater must be pumped into high-pressure injection systems 500 meters below ocean surface. A surface pump cannot create enough suction head to pull water 500 meters up. A vertical turbine pump submerged at depth creates pressure immediately, eliminating suction limitations.

Real application: An offshore platform pumps 5,000 barrels per day of seawater through sand filters and into 200+ bar injection lines. Vertical turbine pumps handle this continuously for 20-year platform lifespans.

Cost: ₹15-50 Lakh for deep-sea models because corrosion resistance demands 316 stainless steel throughout (not just wetted parts like surface pumps). Bronze impellers (₹8,000 each for replacements) resist seawater corrosion better than ductile iron (₹2,000 each). Long-term reliability justifies the 5x cost difference.

Unique limitation: Vertical turbine pumps cannot be serviced in-place. To replace a bearing at depth, you pull the entire pump up through the pipe (100-500 meters), disassemble, repair, and lower back down. A single bearing replacement costs ₹2-5 Lakh in labor and equipment rental.

Horizontal & Vertical Orientation: Installation Impact

Horizontal centrifugal pumps have shaft parallel to ground. Water enters one side, exits the other side. Installation is straightforward—mount on a concrete pad, bolt to motor, connect piping. Maintenance is simple—remove top cover, access bearings and seals from above.

Vertical centrifugal pumps orient shaft top-to-bottom. This configuration solves space limitations. A vertical pump occupies 1/10th the footprint of a horizontal pump of equal capacity. Industrial facilities often choose vertical purely for footprint reduction, sacrificing ease of maintenance.

Real trade-off: A Mumbai chemical plant chose a vertical pump to save ₹50,000 in foundation concrete. But bearing replacement now requires ₹80,000 in crane rental and ₹40,000 in specialist labor (regular technicians can’t reach the bearing from below). The capital cost savings disappeared after one maintenance cycle.

India-specific context: Land costs in Mumbai, Bangalore, and Hyderabad make vertical pumps economically sensible despite higher maintenance cost. Rural facilities with abundant space prefer horizontal (lower maintenance cost beats real estate savings).

Inline Centrifugal Pumps: Compact Flow Management

Inline pumps integrate pump and motor into one compact cartridge that threads into existing piping. Instead of building separate pump and motor units connected by coupling, an inline pump IS the coupling. Discharge port aligns directly with downstream piping. Installation footprint drops 70%.

Where they solve problems: HVAC systems, heating loops, small process circulation. Inline pumps move hot water (80°C) through building radiators at modest pressure (3-5 bar). Cost: ₹10,000-30,000. Maintenance: Remove unit from piping, take to shop for bearing replacement (₹5,000). No on-site service required.

Real application: A data center cooling loop circulates 50°C water through 500 computer servers. An inline pump at 10 m³/h solves this at 1/10th the cost and space of a traditional centrifugal setup.

Limitation: Maximum pressure is 16 bar. Try to push an inline pump beyond this and internal components fail in days. This 16 bar ceiling means inline pumps are restricted to low-pressure applications—HVAC, closed-loop heating, low-pressure circulation.

Pumps in Real Indian Applications: Selection Criteria

Oil & Gas: ONGC operates 2,000+ centrifugal pumps. Reservoir crude at 100+ bar requires split-case or multi-stage designs. Seawater injection at depth demands vertical turbine pumps. Each pump type is mandated by pressure, flow, and distance requirements—not engineer preference.

Petrochemical (Reliance, IPCL): Viscous hydrocarbons at elevated temperature (100-150°C) demand special designs. Centrifugal pumps designed for water cavitate when handling 100+ centiStoke oil. Reliance addresses this by using positive displacement pumps for high-viscosity, reserving centrifugal only for low-viscosity streams.

Power Generation (NTPC, Tata Power): Cooling water systems use end-suction or split-case pumps depending on pressure. NTPC’s 500 MW thermal plant pumps 50 m³/s through cooling towers at 3 bar—accomplished with 3-4 massive end-suction pumps (one per 15 m³/s). Capital cost: ₹15-20 Lakh.

Water Utilities (State Water Boards): Municipal water supply relies on end-suction and vertical turbine pumps. A typical district uses 20+ booster pumps in series, each adding 3-5 bar pressure. Total head (vertical lift + pressure) can reach 100 meters for hilly terrain. Multiple smaller pumps in series prove more reliable than a single mega-pump.

Pump Selection Decision Tree: Practical Framework

Start with pressure requirement:

- 0-20 bar → End-suction or inline pump

- 20-50 bar → Split-case pump

- 50-200 bar → Multi-stage pump

- 200 bar → Special high-pressure designs (piston pumps, not centrifugal)

Add flow requirement:

- <10 m³/h → Inline or small end-suction

- 10-100 m³/h → Standard end-suction or split-case

- 100-1,000 m³/h → Split-case or multi-stage

- 1,000 m³/h → Multiple pumps in parallel (rarely single pump)

Consider installation environment:

- Limited space → Vertical or inline

- Deep water/well → Vertical turbine

- Surface installation with maintenance access → Horizontal

- Reliability-critical (24/7 operation) → Redundant smaller pumps vs. single large pump

Temperature & fluid type:

- <60°C clean water → Standard designs

- 60-150°C hydrocarbon → Engineered high-temp seals & bearings

- Slurry/solids → Special wear-resistant designs

- Seawater → Corrosion-resistant materials (316 stainless, bronze)

Real example: An IOC refinery needs to pump 200 m³/h of crude at 80 bar, 120°C. Decision tree says: 80 bar → split-case required. 120°C → requires high-temperature mechanical seals (₹15,000 vs. ₹3,000 standard). Result: Split-case pump rated 200 m³/h, 80 bar, with high-temp seals = ₹3.5 Lakh investment. The wrong pump (end-suction at these pressures) would fail seal in 30 days = ₹1.5 Lakh repair.

Advanced Tips Every Mechanical Engineer Should Know

Tip 1: NPSHa vs. NPSHr determines suction capability. Net positive suction head available (what you can provide) must exceed NPSHr (what pump demands). Undersized suction pipes reduce NPSHa, causing cavitation even if NPSHr specs are met. Most cavitation failures trace to piping underestimation, not pump design.

Tip 2: Pump efficiency curves show 10-15% efficiency drop at 50% flow. Operating a 100 m³/h pump at 50 m³/h burns 45% more electricity than the nameplate horsepower suggests. Variable frequency drive (VFD) saves ₹1-2 Lakh annually in electricity for high-duty pumps, justifying ₹5-10 Lakh VFD hardware in 5-year payback.

Tip 3: Coupling alignment (<0.002″ TIR) prevents 60% of bearing failures. Laser alignment (₹800 tool investment) saves ₹50 Lakh in avoided failures over pump lifetime. Most plants skip this because laser seems expensive—false economy.

Tip 4: Vibration >5 mm/s predicts seal failure 7 days ahead. Daily vibration monitoring with Fluke 805 (₹1,50,000) pays back in one prevented failure. Schedule seal replacement at 5 mm/s instead of waiting for catastrophic 10 mm/s failure.

Tip 5: Suction strainer pressure drop indicates when cleaning is needed. Design suction strainers for 0.5 bar maximum drop. Above 1.5 bar, recirculate to tank and clean immediately—ignoring this causes ₹2-5 Lakh cavitation damage.

Tip 6: Material compatibility matters more than pressure rating. Stainless steel costs 3x carbon steel but lasts 10x longer in corrosive service. Petrochemical plants use stainless exclusively despite cost because carbon steel fails in months.

India-Specific Economic Context: Making Decisions Under Cost Constraints

ONGC, IOC, and Reliance operate under strict capital budgets. A split-case pump at ₹3 Lakh seems expensive versus an end-suction pump at ₹50,000. But if the application requires 60+ bar, the end-suction pump will fail in 6 months (₹1.5 Lakh seal repair + 48 hours downtime costing ₹2-5 Lakh production loss). The ₹2.5 Lakh upfront investment in split-case avoided ₹3.5-6.5 Lakh losses.

Agricultural sector faces different economics. Farmers irrigating 10 hectares cannot justify ₹15,000 annual electricity costs to run large pumps. Submersible pumps at ₹1-1.5 Lakh with 5-year lifespan work financially (₹200-300 Lakh capex per year across 2M users = ₹400-600 Crore annual pump replacement market in India).

Essential Pumping Tools & Equipment

Fluke 805 Vibration Meter – ₹1,50,000: Measures vibration before seal failure occurs. Detects bearing degradation 7 days ahead.

Extech IR267 Thermal Camera – ₹50,000: Non-contact bearing temperature. Hotspots indicate cooling inadequacy.

SKF TMMA 50H Laser Alignment Tool – ₹80,000: Achieves ±0.001″ TIR alignment preventing radial thrust bearing failure.

Bosch GLM 120-40 Laser Distance Meter – ₹3,500: Measure NPSHa suction conditions accurately before installation.

Oil Analysis Kit (Spectro Scientific) – ₹25,000: Monthly fluid sampling detects seal wear 30 days before failure.

Bearing Puller Set (SKF/Mitutoyo) – ₹8,000: Required for bearing removal without impact damage.

Common Pump Selection Mistakes Mechanical Engineers Make

Mistake 1: Choosing pressure rating by “safety factor” not application requirement. Engineer selects 100 bar pump for 30 bar application thinking “extra safety helps.” Reality: Over-pressurized pumps cavitate at low flow, destroy impellers, and cost 3x more. Pressure rating must match required pressure ±10%, not 3x higher.

Mistake 2: Undersizing suction piping diameter. Spec says “1-inch suction pipe minimum” so engineer uses 1-inch. Reality: Suction velocity >2 m/s causes cavitation. A 200 m³/h pump actually needs 2.5-inch suction pipe, not 1-inch. Cavitation damage: ₹2-5 Lakh.

Mistake 3: Installing pump too close to water source. Suction lift >6 meters causes NPSH depletion and cavitation. A borewell pump must be placed within 6 meters of water surface or submersible design required. Ignoring this causes impeller destruction in weeks.

Mistake 4: Mixing pressure ratings when piping branches. Main discharge at 80 bar but engineer connects 20 bar relief valve to 100 bar pressure gauge line. Over-pressurized gauge explodes (dangerous) or splits casing. ALL components must be rated for maximum system pressure.

Mistake 5: Assuming bearing temperature <80°C is safe. Bearing temperature 75-85°C is actually dangerous zone indicating cooling inadequacy. Safe operating range: <70°C. Above 85°C, grease oxidizes and bearing fails in weeks. Temperature trending predicts failure 30 days ahead.

Master Technical English for Global Oil & Gas Careers

Present pump specifications and failure analysis confidently to international operators. Preply tutors teach engineering professionals:

- Technical pump specification writing (NPSH, head, power calculations)

- IELTS/TOEFL for Middle East oil & gas employment (Saudi Aramco, Kuwait Oil)

- Mechanical terminology (impeller, cavitation, radial thrust, seal chamber)

- Presentation skills for pump performance reports

Start free trial

₹1,200-2,000 per hour vs. ₹50,000+ in-person courses. Middle East jobs pay 3x India salary—language investment pays back in weeks.

Conclusion: From Theory to Real Decision-Making

Bottom line:

- ✅ Centrifugal pump type determines system reliability (80% of failures trace to wrong pump selection)

- ✅ Pressure requirement drives pump type: 0-20 bar (end-suction), 20-50 bar (split-case), >50 bar (multi-stage)

- ✅ Installation environment matters: space-limited (vertical), deep wells (vertical turbine), surface (horizontal)

- ✅ Material compatibility beats pressure rating in corrosive service

- ✅ Vibration monitoring (₹1.5L investment) prevents ₹50L failures

Don’t guess pump selection. One wrong choice costs your plant ₹1.5-5 Lakh in repairs plus 24-48 hour downtime. Use the decision tree above. Choose pressure-matched design. Verify suction conditions. Avoid ₹3-6 Lakh mistakes preventable with 30 minutes planning.